The promise of quick cash has landed thousands of unsuspecting homeowners across the country with 40-year liens attached to their homes or lawsuits demanding thousands of dollars, in what Florida’s attorney general now calls a deceptive scheme to swindle customers out of their home equity. Attorney General Ashley Moody filed a lawsuit Tuesday against MV Realty, a Florida-based company that was the subject of a national collaborative investigation by eight local television news stations in November.

“For a company to prey on unsuspecting homeowners in a way that locks them into a 40-year obligation designed to siphon away equity from the property is disgraceful,” said Moody.

Florida’s action seeks to enjoin enforcement of MV Realty’s contracts with consumers, prevent future deceptive and unfair practices, return the money the defendants wrongfully took from homeowners and impose civil penalties. It is unclear whether legal action would apply to homeowners in other states.

The company responded with a statement saying, “MV Realty has always been committed to transparency in all of our business transactions, and we are confident that any inquiry will confirm that our team has operated in full compliance with the law.”

MV Realty was co-founded by former reality show contestant Amanda Zachman, formerly Amanda Zuckerman, who appeared on CBS’s “Big Brother” in 2013. She is also named individually in the Florida attorney general’s lawsuit.

A team of reporters from Cox Media Group-owned television stations in Atlanta, Boston, Charlotte, Dayton, Jacksonville, Orlando, Pittsburgh, and Seattle spent four months investigating MV Realty’s business practices, speaking with former company insiders and homeowners who signed contracts with the company.

A search of real estate records documented more than 6,000 properties in seven states with liens filed by the company. The contracts are typically written to remain in effect for 40 years, longer than the duration of most mortgages. Attorneys general in Florida, Georgia, North Carolina, and Pennsylvania said they were investigating the company after receiving complaints from homeowners.

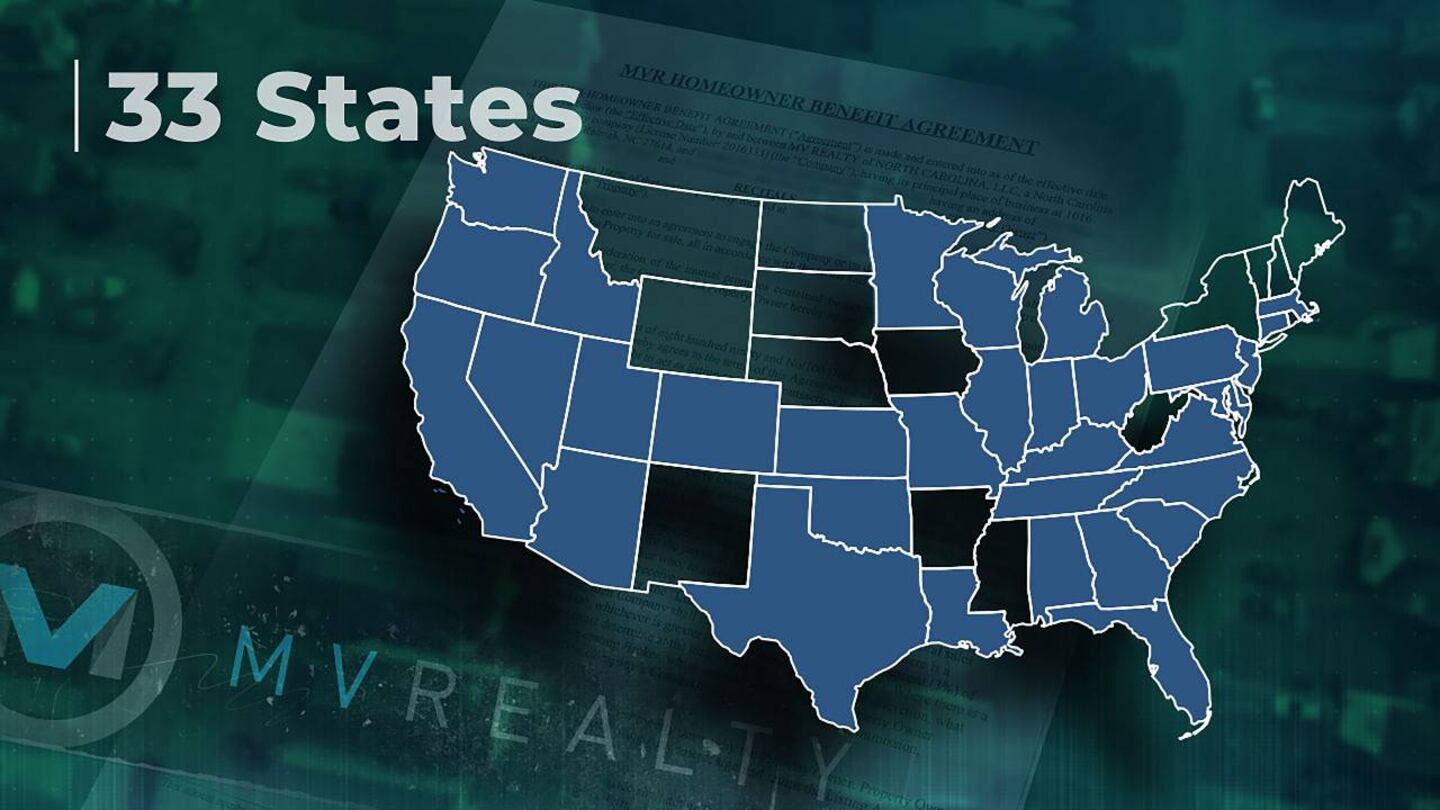

MV Realty’s website says it operates in 33 states and offers what the company calls a Homeowner Benefit Program.

The company pays customers cash up front, ranging from a few hundred to a few thousand dollars, based on the value of the home. In exchange, owners sign an agreement granting the company the exclusive right to serve as their realtor if the owner decides to sell. The company has filed those written agreements in recorder’s courts across the country, attached to the properties as a lien.

Atlanta-area resident Ira Dorin told WSB-TV he would never have signed the MV Realty contract if he’d known it lasted 40 years.

“The gentleman said if I chose to opt out, I would just go ahead and give him the $817 and we’ll be on our merry way,” Dorin recalls.

Instead, when the disabled Navy veteran opted to use a different realtor a year later, the company sued him for violating his contract. Dorin said he paid MV Realty more than $9,000 to avoid holding up his sale. The company ended up making even more than the realtors who actually handled the sale.

“It’s really unconscionable and it’s a very lopsided contract by a sophisticated company against unsophisticated homeowners,” said Atlanta Legal Aid attorney Dina Franch.

Atlanta Legal Aid started researching MV Realty after being contacted by another homeowner. With help from a Georgia State University researcher and law students, they mapped homes with MV Realty contracts and found 71% are in majority Black neighborhoods.

Many of the homeowners who signed MV Realty contracts are also elderly, and several said they had cognitive or medical issues that limited their understanding of what they were signing.

In 2021, Channel 2 Action News reported on a woman who had trouble selling her fire-damaged home because of an MV Realty agreement.

“They’re holding her hostage, and this is paying the ransom to get out,” said Rebecca Broich, a Georgia realtor who agreed to forego her own commission so the woman could afford to pay MV Realty’s penalty.

WFTV-TV in Orlando first investigated the company two years ago when Eleanor Gardner signed a contract she did not understand. She says an MV Realty representative came to her house and offered to pay her to join its Homeowner Benefit Program. Gardner says he explained she could also collect $100 more for every person she referred. Then, her doorbell rang.

“There were two ladies, they were two notaries. He didn’t tell me anything was going to be notarized,” Gardner said.

According to Gardner, she signed three documents and was paid $1,000, giving MV Realty the exclusive right to sell her home someday. But she says, for months, the company failed to send her a copy of the contract she signed. When she finally got it, Gardner says it included pages she never saw.

“I don’t want anything to do with those people,” Gardner said.

Since then, WFTV’s Action 9 found MV Realty filed at least 60 lawsuits against homeowners across central Florida to enforce liens that blocked selling their homes unless they used its real estate company.

MV Realty declined multiple requests for an on-camera interview but, in an email, MV Realty Communications and Public Relations Director Diana London wrote, “We do enforce our agreements when homeowners violate their contracts. But we make sure that homeowners clearly understand the terms of the agreement before signing.”

“It was a sweet, fast talk, you know?” Sheila Feliciano told ActionNewsJax in Jacksonville.

MV Realty gave Feliciano $650 to list her home if she ever sold it. A year later, she put her house up for sale with another company and MV Realty placed a lien on her property and sued her for $7,800, 12 times the amount she received from them up front. Feliciano said she didn’t realize the cash locked her into a 40-year contract.

“I would have to die and come back in order to serve that time of the contract to be free of it,” she said.

Nearly all of the homeowners interviewed said they did not understand that the contract would remain in effect for 40 years, or that a lien would be attached to their property. None said they’d sought out MV Realty; instead, they were approached by a telemarketer or someone knocking on their door.

In Charlotte, Patricia Bandy told WSOC-TV that MV Realty offered her $900 after she went online looking for a short term loan. She said she read the contract but didn’t realize it would last 40 years. Bandy initially tried to sell her house with MV Realty to abide by the contract.

“For 11 days, I contacted the realtor that I was assigned. I continuously asked for them to come out and do pictures or tell me what to do,” Bandy said.

After she ultimately decided to hire another realtor, MV Realty filed court papers demanding she pay a 3% penalty.

“It was $14,000 and some change,” she said. “It’s an incredible amount of money, especially when you’re middle-class working America.”

But she, like Dorin, said she paid the money to avoid holding up her sale.

“I’m angry. I don’t like being taken advantage of. I work hard for the money that I have,” Bandy said. “I have a family to take care of. And what they did essentially was try to stop us from having our piece of what we consider to be the American dream.”

In a written response to WSOC’s Action 9, MV Realty said it was very quick to help sell Bandy’s house and that it even found her a buyer. The company said she didn’t have legal standing to cut ties.

In Seattle, a whistleblower who worked as a telemarketer for the company told KIRO7-TV she was required to make 450 calls per day to unsuspecting homeowners, often using tactics like phone spoofing to look like the call was from a local number.

“I felt like I was taking advantage of people,” said the woman, who asked not to be identified for fear of retaliation from the company. “We were to be aggressive in our approach. It was a lot of high pressure for anybody that we called.”

She provided the reporters with a trove of internal training materials from the company that documents the sales tactics, now also cited in the Florida lawsuit.

MV Realty said it uses a transparent process, adding, “We do not cold call and only reach out to prospects who have opted-in to receive information from us via our website or a partner website.” The company did not disclose the names of its partners.

“I thought it was wrong, because we were to bait people,” she added. “Most of them actually were elderly that you would get over the phone.”

Vietnam veteran James Heath, 78, said he got just over $2,200 from MV Realty.

“I thought maybe it was a scam,” said Raven Lampkin, Heath’s daughter, who happened to stop by his home the day he signed the deal. She was able to intervene and terminate the contract during the company’s three-day cancelation window.

Washington state Sen. Mark Mullet, the chair of the Senate Business, Financial Services & Trade Committee is holding a hearing on this business practice Friday.

“I think our job is to maybe put in some protections so people who might be in a difficult time in their life financially are making long-term decisions that don’t come back to bite them later on,” Mullet said.

A Washington attorney general’s spokesperson wrote in a statement, “Our office has a longstanding policy that it does not comment on investigations, including confirming whether they exist. However, I can share that our office is aware of and very concerned about these allegations.”

Sarah Mancini with the National Consumer Law Center said MV Realty’s program could be considered a loan, secured by a lien on the home.

“It raises a huge number of concerns about the legality,” Mancini said. “And if this is a loan transaction, which there are a lot of facts that suggest this is really a loan, if that’s the case, they violated the Truth in Lending Act.”

U.S. Sen. Sherrod Brown (D-Ohio) told WHIO-TV in Dayton he was glad to see the results of the collaborative reporting project.

“There are always con artists ready to pounce,” Brown said. “And when we see people taking advantage of homeowners or renters, we spring into action.”

Brown added that the company could face scrutiny from the Senate Committee on Banking, Housing and Urban Development, which he chairs.

“I want to know more about it,” he said. “That’s why I’m listening to what Cox [Media Group’s investigative unit] is doing on this. We are just beginning to look at it, and it will not be before the first of the year. But I’ll be chair of this committee in January again.”

MV Realty’s website was updated in recent weeks to include clear disclosures about the Homeowner Benefit Program at the top of the page. The site now states the Homeowner Benefit Agreement is “not a loan,” and it does not lien property but “file a memorandum … to serve public notice of the homeowner’s obligations.”

“If it walks like a duck, quacks like a duck, it is a duck. There are times when individuals may have a document that they form or title as a memorandum, but it has the same legal validity of a lien,” said Montgomery County, Ohio Recorder Brandon McClain, adding that he’d never heard of a 40-year exclusive listing agent agreement before. WHIO found more than three dozen had been filed in his county.

“I just want to give them their money back and get this 40-year memorandum off my mortgage, off my house,” said Dayton-area resident Debbie Chasteen.

Chasteen said she accepted $485 from MV Realty after getting a phone call in June. She says she told the caller it sounded like a scam.

“And he said, ‘Oh no, ma’am, it’s not a scam,’” she recalls. “‘We’ll pay you money if you’ll let us list your house.’”

She saw the original NewsCenter7 I-Team report and started researching the company. She’s particularly concerned about the provision that if an MV Realty customer dies, the deal remains in effect. The heirs have 10 days to transfer the deal, or they may have to pay the 3% penalty as well. She plans to leave her home to her children.

Filings in Pennsylvania and Massachusetts raise additional concern because they refer to the Homeowner Benefit Agreement filings as “mortgages” when recorded on the property. Complicating matters even further, Pennsylvania state law says real estate listing agreements can be no longer than one year.

MV Realty insists it follows all state laws and that its Homeowner Benefit Agreement is not a listing agreement, just a contract to potentially have a listing agreement for the next 40 years.

“I think it’s reprehensible,” said Pittsburgh-area real estate attorney Jim Herb, adding that he thinks the company’s tactics violate Pennsylvania’s Unfair Trade Practices and Consumer Protection law.

“It’s an unfair trade practice for a business to engage in any confusing or deceptive methods,” Herb told WPXI-TV. “In my opinion there should be plain language in here (in the contract).”

Pittsburgh-area homeowner Georgette Snowden, 74, was stunned when 11 Investigates told her about the lien on her property and that it will last for 40-years.

“No, I didn’t know there was a lien. I would never have agreed to that had I known it was a lien,” Snowden said. “My head’s spinning right now.”

MV Realty gave Snowden $391, resulting in the 40-year mortgage lien on her property, which is valued at about $115,000 on Zillow.

Another Pittsburgh-area resident named Keith asked not to have his last name disclosed, but said he received $546 to sign MV Realty’s Homeowner Benefit Agreement.

“Free money, that’s how they put it. It was free money to you,” Keith said. “Never said anything about a lien. Never said anything of the sort.”

The contract says MV Realty will get a 6% commission if it sells the property; but even if it doesn’t and another broker is used, it says the company still gets a 3% commission, which would result in thousands of dollars, in exchange for the few hundred dollars homeowners received up front. The contract also says “for sale by owner” is prohibited.

“The agreement is very clear and is in plain English,” said MV Realty in a written statement. “Any filing is specifically limited to protecting MV Realty’s rights under its agreement. It has no adverse effect on homeowners. The filing is not only accurately described in the agreement, but for the avoidance of any doubt, the filing itself is signed by the homeowner, and that document they signed is what is recorded with the county.”

The company said it would allow Snowden to return the money and terminate her contract since she has expressed some confusion regarding her understanding of the terms of the agreement. It has not afforded that option to several other homeowners who requested it.

Boston-area real estate attorney Marc Canner reviewed MV Realty’s contract and told WFXT-TV he would tell a client not to sign an agreement with the company.

“If a homeowner has an issue with the MV Realty contract, the underlying agreement requires they go to binding arbitration and not get into a class action lawsuit. That means they’re not going to be able to seek relief in state courts,” Canner said.

He recommends homeowners consult an attorney before signing anything that involves their home.

“Homeowners may not understand the gravity of the situation. They’re receiving a few hundred dollars and they could [owe] several thousand dollars down the road,” said Canner.

The Massachusetts Attorney General’s Office told 25 Investigates it is aware of MV Realty’s business practices but couldn’t comment further.

Secretary of the Commonwealth Bill Galvin, who oversees most land records in Massachusetts, told Boston 25 Investigates his office is “very interested” in finding out if MV Realty is “engaging in predatory practices.”

“I have significant concerns about what they’re doing,” Galvin said.

Based on investigations from:

- Justin Gray and Terah Boyd, WSB-TV Atlanta

- Jason Law, WFXT-TV Boston

- Jason Stoogenke and Mike Stolp, WSOC-TV Charlotte

- John Bedell, WHIO-TV Dayton

- Emily Turner, WJAX-TV Jacksonville

- Todd Ulrich and Gerry Mendiburt, WFTV-TV Orlando

- Angie Moreschi, WPXI-TV Pittsburgh

- Jesse Jones and Jillian Raftery, KIRO-TV Seattle

©2022 Cox Media Group